Affordability is an important selection criteria used by property managers to ensure the tenant can pay the rent on time comfortably.

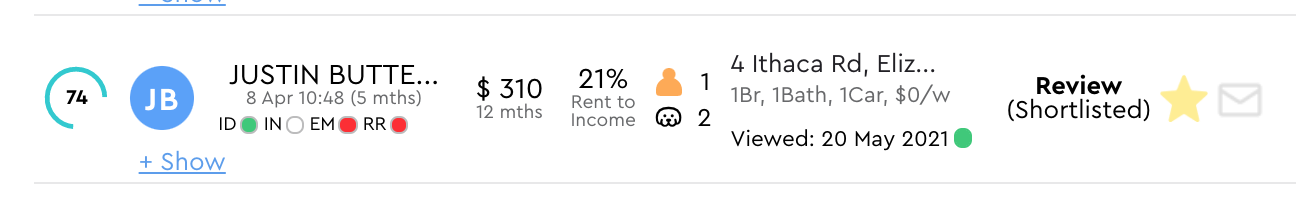

Snug shows the Rent to Income ratio. This is how much of the estimated household income would be used to pay the rent for example 21% in the screenshot below.

The Rent to Income ratio presented on Snug is based on data provided by the renter, which can be assessed and edited by the property manager to normalise for average income ongoing.

Snug calculates rental affordability using the following method:

Affordability = Total Household After Tax Weekly Income / Rent per week

Income is based on the applicant's entered income for employment such as salary, government benefits such as centrelink and other income for example investment interest or dividends.

eg. $400 per week rent and three applicants household income after tax totals $1200 (for example $600+$400+$200) then the affordability calculated is 33% being 400/1200.

Generally 20-50% is acceptable and 30% often regarded as comfortable affordability without creating rental stress. However, the property manager should determine the appropriate affordability for their client, portfolio, applicant and market conditions.

Rental affordability based on income may not be suitable for some applicants such as retirees or those on sabbatical or between jobs that have significant savings from which to pay the rent.

Also please note for Government rental schemes eligibility and Tribunal purposes other calculation methods may be used.